-

AmpliTech Group Reports Quarterly Results for Q2’22: Records a YoY 347% Quarterly Revenue Increase, 491% Increase in Total Gross Profit, Gross Profit Margin YoY Increases from 33.6% to 44.5%, and Increases Revenue Guidance for FY 2022

Источник: Nasdaq GlobeNewswire / 15 авг 2022 08:00:01 America/Chicago

Hauppauge, NY, Aug. 15, 2022 (GLOBE NEWSWIRE) -- AmpliTech Group, Inc (Nasdaq: AMPG), a designer, developer, and manufacturer of state-of-the-art signal-processing components for satellite, 5G, and other communications networks and a worldwide distributor of packages and lids for integrated circuit assembly, and designer of complete 5G/6G systems today announced earnings. The company will host an investor call Thursday (8/18) at 4:00 PM EST

Investor Call Details

Date/Time: Thursday, August 18th at 4:00 pm ET

Dial-in Number: 1-888-222-5806 (domestic) or 1-412-902-6516 (international)

Online Replay/Transcript: Audio file and call transcript will be posted to AmpliTech’s news page when available.

Investor Questions: May be submitted to investors@amplitechgroup.com prior to or during the callQ2 2022 Highlights

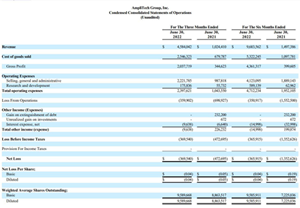

- Revenue rose 347.5% year-over-year to $4,584,042 in Q2’22 vs. $1,024,410 in Q2’21

- Q2’ 22 gross profit improved to $2,037,719 (44.5% gross profit margin) from Q2’ 21 gross profit $344,623 (33.6% gross profit margin)

- Net loss decreased by 21.8% in Q2’22 to $369,540 vs. Q2’21 net loss of $472,695

- Completed move of AmpliTech Inc and Specialty Microwave engineering facilities into a single facility in Hauppauge NY to increase operational efficiency and R&D collaboration. Full operational capabilities were re-gained within four weeks after the move took place.

- First AGMDC MMIC chip designs were produced showcasing AmpliTech’s advanced LNA designs in a more flexible form factor. They were debuted along with other products at the International Microwave Symposium and garnered extensive interest across a wide spectrum of customers.

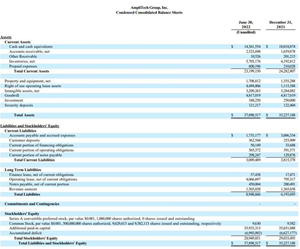

- Year-end cash and equivalents were $14,361,554 with working capital at $20,189,661, giving AmpliTech ample capital to finance its medium to long-term growth initiatives and stocking inventory on an unimpeded basis

Forward-Looking Update

- Management expects a profitable Q3 2022 and increases revenue outlook of at least $17M for FY2022, representing a $2M revenue increase from previous guidance of $15M for FY2022, representing a projected 220.8% YoY annual revenue increase over 2021 FY Revenue of $5.3M

- New AmpliTech TGSS service division is expected to be fully functional during Q4 2022, to help telco customers design, implement, deploy, and manage complete 5G front-end infrastructure in 5G base stations and 5G O-RAN radios

- AmpliTech’s current order backlog is $8.2M, representing contractual hardware and engineering services anticipated for delivery over the next 9 months

- AmpliTech MMIC chips to continue customer testing and evaluation in Q3 2022 and the company expects to stock an assortment of new MMIC chips for COTS availability by Q1 2023

CEO Commentary

Fawad Maqbool, Founder & CEO, commented, “I am very pleased with our financial results this quarter, which included a one-time major event, as we successfully consolidated our two manufacturing and engineering facilities into one building during this quarter. We now have a fully operational expanded facility located in the Hauppauge Industrial Park, Long Island NY with excess capacity for growth. We regained full operational capabilities within four weeks after the move took place. During this quarter, we also welcomed some long-awaited new developments, including our new MMIC designs, and newly expanded product line, while also building the foundation for our new 5G system group, TGSS. Our AmpliTech Inc division, which designs and manufactures our low noise amplifier designs, delivering highly performant and reliable signal processing components, was complemented by our Satcom Systems division, Specialty Microwave. We recently debuted our new MMIC semiconductor designs, from our AGMDC division in Plano Texas, as well as our Spectrum Semiconductor Materials division in Silicon Valley. The two symbiotic groups will help us with the integrated circuit packaging for MMIC chips.

“Additionally, we plan to offer systems complete innovative true 5G O-RAN radios as well as the planning and optimization services necessary to complete all new 5G installations globally through TGSS, our recently created division. We believe these developments are expected to be incredibly accretive to our business since they provide a more extensive product suite as well as a larger distribution presence. I applaud our whole team’s ability to work cohesively to make this incremental progress and transform the Company from just an amplifier component supplier to a full-service organization with cutting-edge components, systems, and services. This is a big step towards industry recognition and sustained profitability.

Maqbool continued, “Having more comprehensive solutions in our AmpliTech Group product ecosystem, allows us to capture more of the market as evidenced by a 347% increase in revenue. Against this revenue, we also incurred higher costs this quarter due to rising material costs, R&D expenses related to MMIC design and testing, and marketing expenses related to roadshows. We also incurred one-time expenses due to our recent facility move and a one-time accounting reserve expense against an increase in inventory for our Spectrum division. We expect the rest of 2022 to pose some challenges given macroeconomic conditions. However, given our team’s excellent preparedness, we were able to foresee certain conditions and stock inventory in larger quantities, giving us a lower cost basis. Additionally, the domestic production of AmpliTech products allows us to manage our supply chain more efficiently. Backed by our growing product suite, ongoing product research, and improving financials as evident by our growing revenues and increasing profitability, we look forward to continuing to build the AmpliTech brand and keep on developing world-class solutions to solve challenging problems”.

About AmpliTech Group

AmpliTech Group, Inc. designs, develops, manufactures, and distributes state-of-the-art radio frequency (RF) microwave components for global satellite communications, telecom (5G & IoT), space, defense, and quantum computing markets as well as systems and component design consulting services. In December 2021, AmpliTech completed the purchase of the assets and operations of Spectrum Semiconductor Materials Inc. a global specialty distributor of semiconductor components based in San Jose, CA. AmpliTech has a 13+ year track record of developing high performance, custom solutions to meet the unique needs of some of the largest companies in the global industries we serve. We are proud of our focused team's unique skills, experience and dedication, which enables us to deliver superior solutions, faster time to market, competitive pricing, excellent customer satisfaction and repeat business.

Safe Harbor Statement

This release contains statements that constitute forward-looking statements. These statements appear in several places in this release and include all statements that are not statements of historical fact regarding the intent, belief or current expectations of the Company, its directors or its officers with respect to, among other things: (i) the Company's ability to execute its business plan as anticipated; (ii) trends affecting the Company's financial condition or results of operations; (iii) the Company's growth strategy and operating strategy. The words "may" "would" "will" "expect" "estimate" "anticipate" "believe" "intend" and similar expressions and variations thereof are intended to identify forward-looking statements. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, many of which are beyond the Company's ability to control, and that actual results may differ materially from those projected in the forward-looking statements because of various factors. Other risks are identified and described in more detail in the “Risk Factors” section of the Company’s filings with the SEC, which are available on our website. We undertake no obligation to update, and we do not have a policy of updating or revising these forward-looking statements, except as required by applicable law.

Non-GAAP Financial Information

This press release includes a statement relating to the Company’s order backlog. Backlog represents the dollar amount of net sales that we expect to recognize in the future from sales orders that have been received from customers in the ordinary course of business. The Company considers order backlog a relevant and preferred supplemental measure for understanding the Company’s financial and market position. However, such measures have inherent limitations, are not required to be uniformly applied or audited and other companies may use methodologies to calculate similar measures that are not comparable. Readers should be aware of these limitations and should be cautious as to their use of such measures.Company

Twitter: AmpliTechAMPG

Instagram: AmpliTechAMPG

Facebook: AmpliTechIncInvestor Relations

Twitter: AmpliTechIR

StockTwits: AMPG_IRCompany Contact:

Shan Sawant, Director of Communications

AmpliTech Group, Inc.

shan@amplitechgroup.com

646-546-7128Attachments

- AmpliTech Group Reports Quarterly Results for Q2’22

- AmpliTech Group Reports Quarterly Results for Q2’22